VIEWS: 1914

February 13, 2020Get Smart About Your Money: Financial Skills for Families Workshop

Welcome to February! We are 36 days into our New Year’s resolutions and goals. The “new year, new me” attitude has likely run its course for some out there, while others are still fighting the good fight. Congratulations to those who are sticking with it—and to those who may have fallen off the wagon, you are not alone. Let’s get back up and try again.

Many people tend to make resolutions that revolve around healthier eating habits, working out and spending more time with loved ones. While all of these are wonderful and empowering intentions, there is a part of life that is often overlooked, simply because people might not know where to start: financial goals.

Not long ago, this reporter took a workshop on just that. The five-week Financial Skills for Families Workshop, which is offered by the Salt River Financial Services Institution, is a three-hour, one-night-a-week class and a great starting point for gaining control of your finances.

“Everything starts with an understanding of how important financial goal-setting is,” says Gracie Briones, SRFSI financial education training coordinator and workshop instructor.

While the workshop is impossible to summarize in 500 words or less, here are some great takeaways.

Working in a Native Context. On day one, before any concept of money comes into the picture, students take part in a discussion of seasons in regard to our Native ancestors. The “Circle of Life” activity brings Native survival front and center (see example). The concept of planning for the future is engrained in O’odham culture, because in order for our ancestors to survive, they had to prepare for the seasons to come.

Finding Your Values. In this activity, participants rate their personal values in order of importance on a scale of 1 to 5 (1 means very important and 5 means least important; see the chart). Determining what is important to you requires you to think deeply and reveals your financial habits.

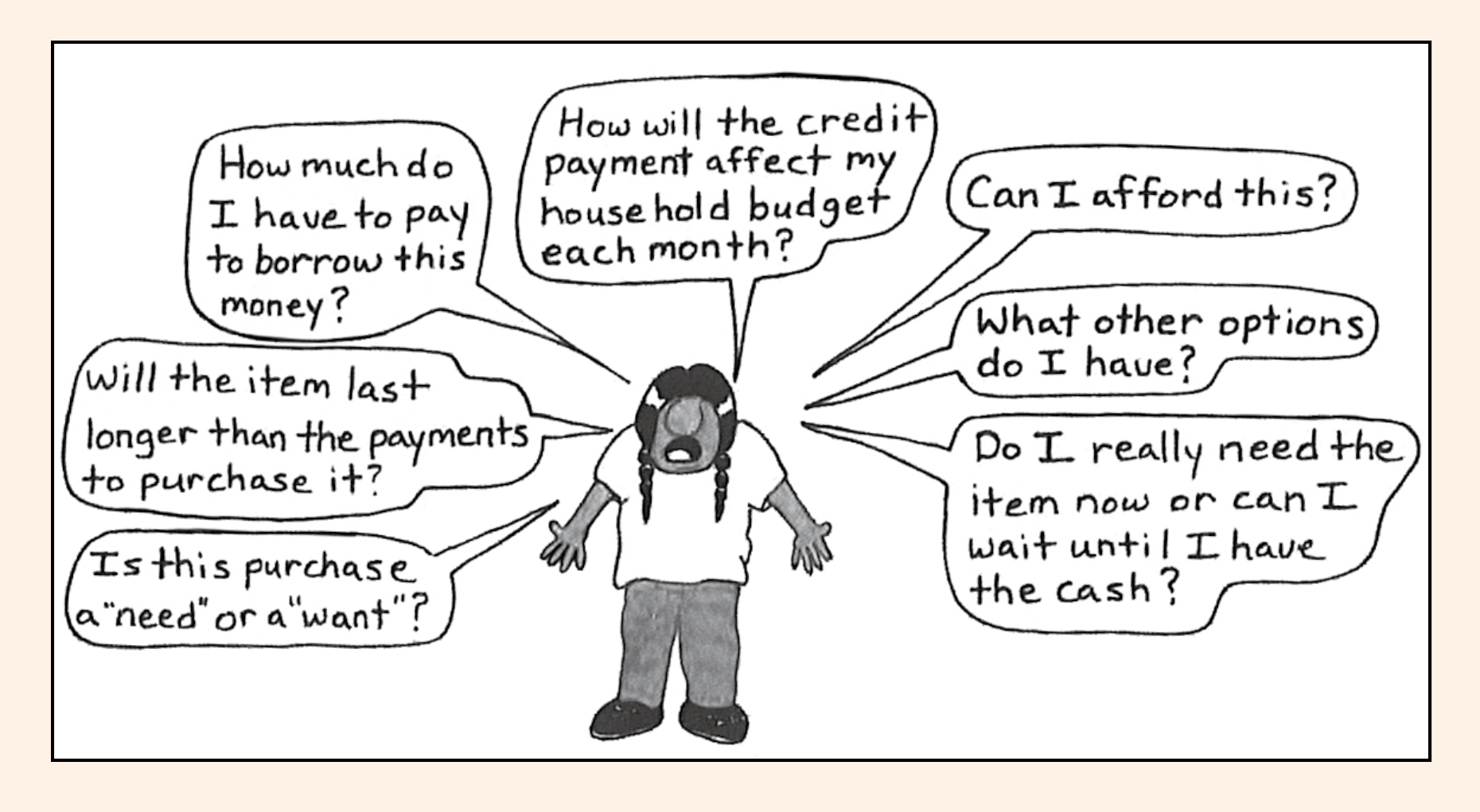

Identifying Wants vs. Needs. In this activity, participants list all the things on which they intend to spend money this year and then divide them into two categories, wants and needs. Understanding and identifying the difference between survival and luxury items puts things into perspective and may help curb impulse shopping because it requires you to think before purchasing.

Making a Spending Plan. This is also known as a budget. Gathering all their monthly expenses, from utility bills to gas to groceries, participants construct a plan for how to pay them. For some, this can be intimidating and may appear restricting, but it prevents you from being caught off-guard financially.

Speed Dating. This is not actual speed dating, but a fun activity in which attendees have three minutes to answer questions with each other, such as “Does your family talk about money?” “How do your parents/spouse handle money” and “Did you have a financial role model growing up?” This activity proves that we are not alone in the journey to gain financial knowledge.

The workshop also covers the basics of setting up a checking/savings account, identifying persuasion tactics in advertising, learning what interest is and how it works, avoiding predatory lending, and how a “local economy” works.

The particular workshop I took was with three Community members. While this workshop is open to all, SRPMIC members receive priority. The classes had a casual, laid-back atmosphere and there was no judgment regarding anyone’s financial questions, situations or goals.

While my personal journey to financial freedom began a few years ago, the Financial Skills for Families Workshop was another way for me to gain more knowledge and see a different way of thinking.

For participant Tristan Schurz, it led to an important moment of reflection. “I was offered this class a few years ago and didn’t take it. I kind of regret it, thinking back on it now. It could’ve saved me a lot of money if I took it back then instead of taking it now,” said Schurz.

For Alejandro Jimenez, the class not only offered eye-opening knowledge, it also meant a promise to share the importance of knowing your finances with the ones close to him.

“It’s like a trick to life. [Financial skills are] an advantage to know because you’re going to have to buy a house, you’re going to have to buy a car, you’re going to have to get stuff in order to survive in society. This is information that has to be passed on.”

So what’s the bottom line? Don’t think your situation is hopeless. You have resources. You can learn and you can take control.

“You can always come in and start somewhere,” says Briones. Her objective through the workshop is to empower people to learn financial skills. “It’s a lifetime skill and it’s going to empower you to make wise financial decisions and come out on top.”

The next Financial Skills for Families five-week workshop starts in April. Watch future issues of O’odham Action News for dates and times when the information becomes available.

The curriculum of this workshop was developed by the First Nations Development Institute and First Nations Oweesta Corporation. Gracie Briones is a certified instructor with the Salt River Financial Services Institution.